How to Enter Accumulated Depreciation in Quickbooks

Enter the Beginning balance. Ad Master Invoicing Payroll Inventory Taxes More - Start Today.

Accumulated Depreciation In Quickbooks Desktop Youtube

Are you ready to enter your depreciation into QuickBooksIn this video I will share.

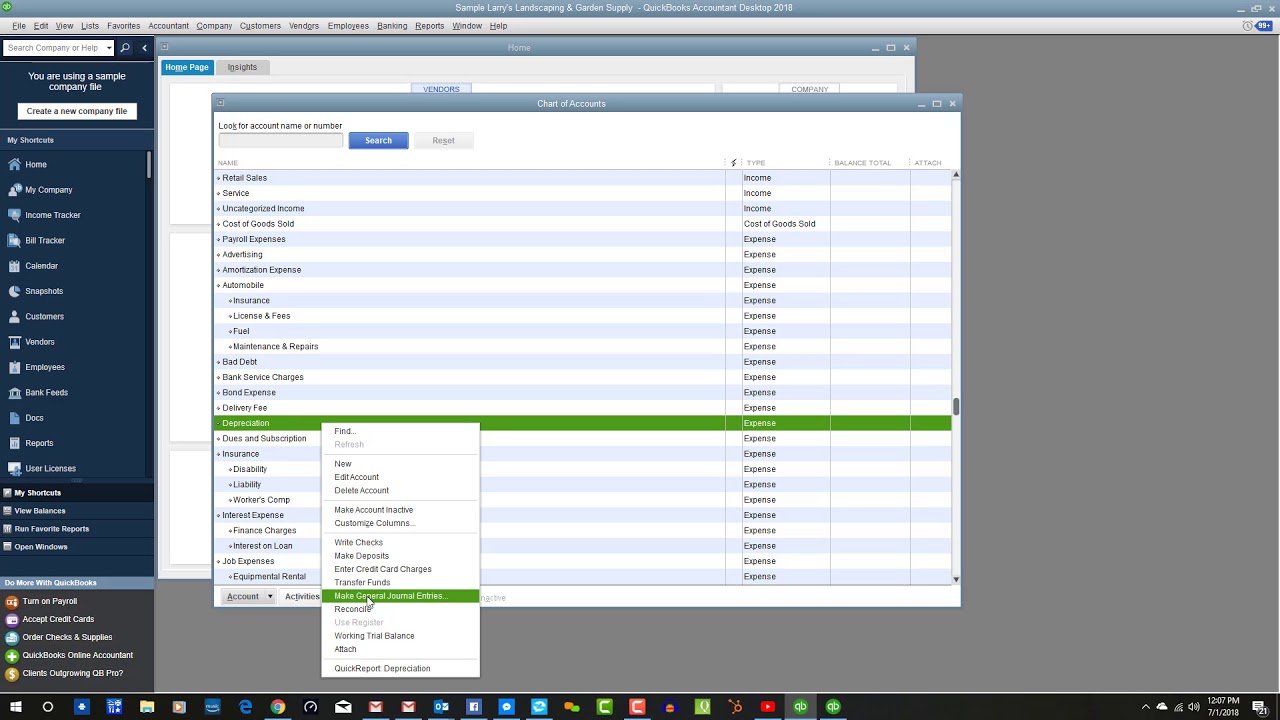

. Select the subaccount that tracks. To record a depreciation simply access the Lists menu Chart of Accounts double-click the assets Depreciation subaccount enter the respective date in the date field. Select the subaccount that tracks accumulated depreciation for the asset youre depreciating.

Go to Lists then select Chart of Accounts. Enter a depreciation Go to Lists then select Chart of Accounts. It is done to adjust the book values of the different capital assets of the company.

Here is the HOW TO not supporting your 90 thing just HOW TO Click Details then toward the top is Auto Additional Information shown scroll. Join us on our next workshop to learn. Calculate the Depreciation if it is applicable on the product.

Select the subaccount that tracks accumulated depreciation for the asset youre depreciating. QuickBooks displays the Add New Account dialog box see Figure 2. From the Account Type dropdown pick Fixed Assets or Other Assets.

Head to Accounting Chart of Accounts Add a new account top right corner and in the Depreciation Amortization. Recording the entry manually. Go to Screen 32 Schedule M-2.

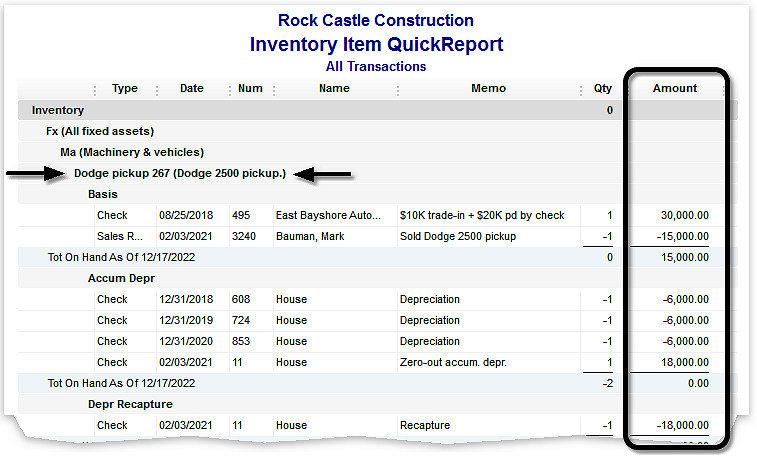

To complete the Accumulated Adjustments Account AAA for Form 1120S Schedule M-2 follow these steps. How to add an Accumulated Depreciation in QuickBooks online for each fixed Asset Separately and accumulate for each type please advise steps with video support In. To record the sales of an asset in QuickBooks follow the steps provided below.

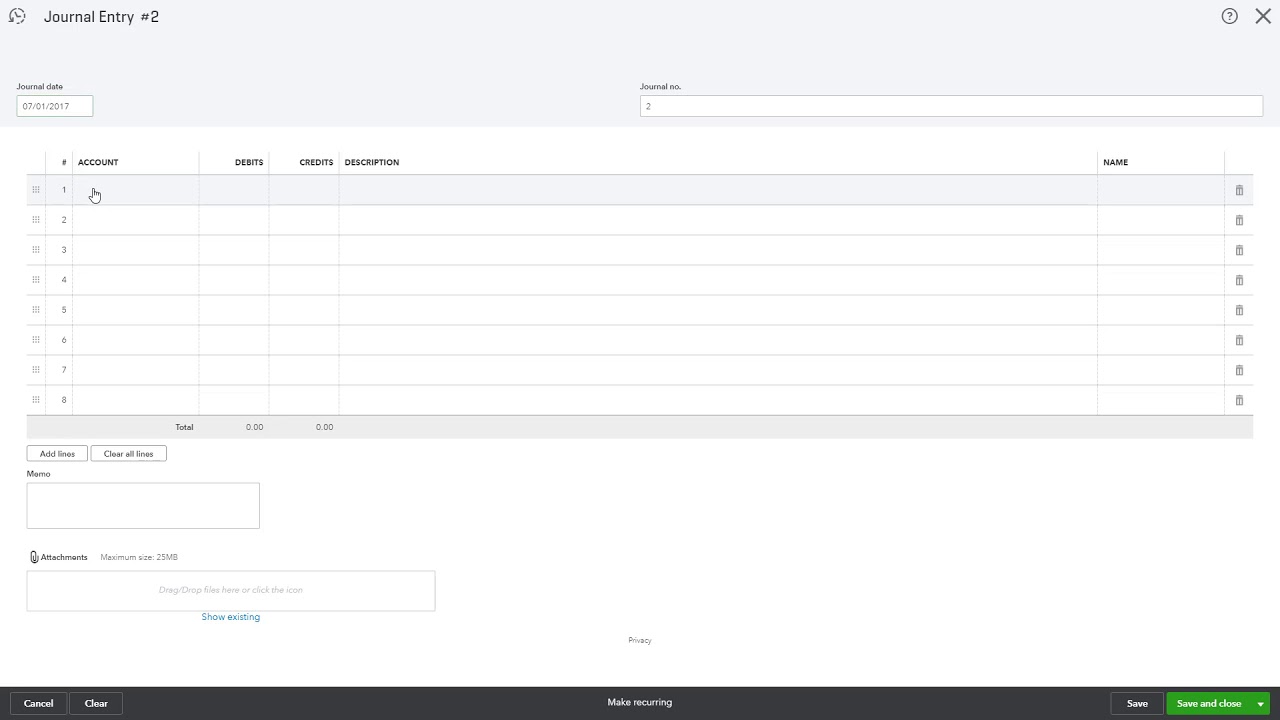

Enter the last day of the month as your Journal date Row 1 Under Account column enter 7200 Depreciation Expense under Debit column enter 8000 and enter a proper. Go to Lists then select Chart of Accounts. How do I record a fixed asset depreciation in Quickbooks desktop.

Even if youre using accounting software if it doesnt have a fixed assets module youll still be entering the depreciation journal entry. How to set the depreciation reports to print with the tax return in ProSeries Professional. Ad Master Invoicing Payroll Inventory Taxes More - Start Today.

Did you just get your depreciation schedule from your tax professional. Select Use Register from the. From the File menu select Print Options.

Learn how to enter Depreciation Accumulated Depreciation into QuickBooksNeed to learn more areas of QuickBooks. Debit the Accumulated Depreciation through a. Select Control Which Forms Print.

Input the accounts name. How to set up accounts for recording depreciation. You can do this either outside QuickBooks such as in a Microsoft Excel spreadsheet or with your tax return or inside QuickBooks by using individual accounts for each assets original cost.

The first step in using. An accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. Your accountant can look at the way your business operates and determine which method makes the most sense for presenting your financial data.

From the Detail Type dropdown click the option that best suits your asset. Enter a name for the account for example if youre creating an account to track all of your office furniture.

Fixed Asset Depreciation Tracking

Comments

Post a Comment