Funding Sources Which Use Income as Only Criteria to Loan

Skip the Bank Save. SHORT TERM SOURCES OF FINANCE FUNDS.

Save Money Quickly With a Low Fixed Rate Loan.

. An asset-based loan is one that uses assets as income. SBA 7 a loans. Baseline small-business loan requirements typically include a good credit rating and an annual income of at least 20000 if youre new in the business some lenders will go as low as 10000.

Seasonal or part-time pay. Collateral for the loan you are seeking or from a co-signer. Private Limited Company can accept deposits from the Members upto 100 of aggregate of the paid up share capital and free reserves.

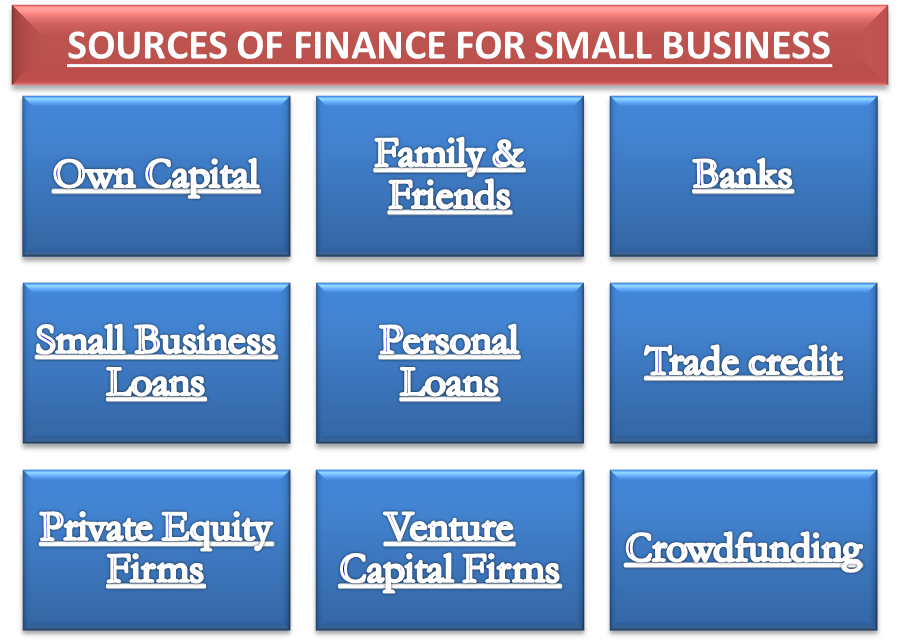

LONG TERM SOURCES OF FINANCE FUNDS. Of all the federally sponsored debt-financing programs this is the most popular and perhaps the best. Other Funding Sources Funding sources also include private equity venture capital donations grants and subsidies that do not have a direct requirement for return on investment ROI except for private equity and venture capital Venture Capital Venture capital is a form of financing that provides funds to early stage emerging companies with high growth.

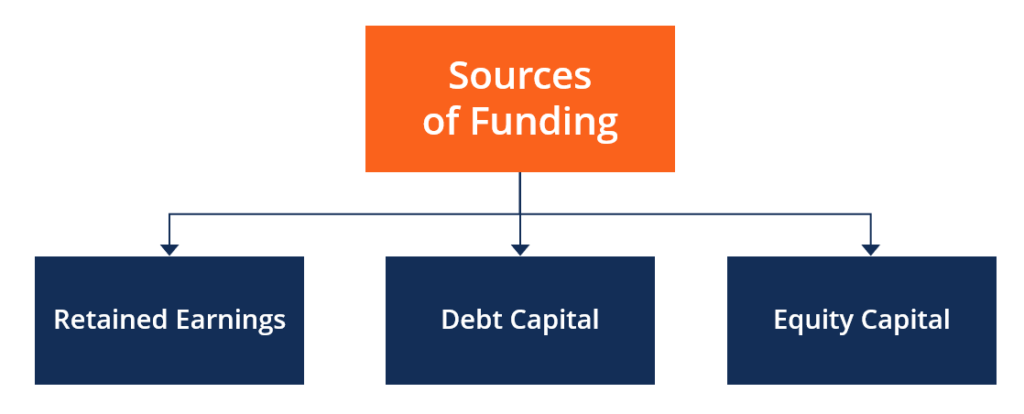

The three major sources of corporate financing are retained earnings debt capital and equity capital. Purchase order financing. Ad A Loan for Almost Anything.

Loan from shareholders. Social security income. Retained earnings refer to any net income remaining after a company pays.

Income from shareholders who are investing in your business. This is the most appealing source of financing because you use your own money to jumpstart your business and dont owe anyone else in the process. Other personal sources like equity in your home a savings account or an IRA you dont have to cash it in just be willing to let the bank take it if you cant pay on your loan.

Project funding is no different but there are several ways you can fund a project. While I have identified 41 sources of funding for your business below are the 5 most common. Debt financing that gives you access to capital without diluting ownership in your business.

Preference Capital or Preference Shares. The days of stated income loans also called no-documentation loans are a thing of. Term loans are typically offered at reasonable interest rates and with longer repayment terms than most other types of business funding.

Preference Capital or Preference Shares. Here we discuss the two types of external sources of finance long-term financing equity debentures term loans preferred stocks venture capital and short-term financing bank overdraft and short-term loans. Firms that provide their owners with income.

Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. Such as low-interest-rate loans and tax incentives provided by state and local governments to help small businesses. A term loan is the type of business loan most people think of when they think of business loans.

Bank loans are the most commonly used source of funding for small and medium-sized businesses. Listed below are some common funding sources with a brief explanation of each that will help simplify things for you. Retained Earnings or Internal Accruals.

The two issues with this type of funding are 1 how much personal savings you have and 2 how much personal savings are you willing to risk. However since exact requirements vary from lender to lender weve reviewed an assortment of lenders who can work around your unique needs. Overall the best sources of funding for small business startups include the following.

Revenue based financing is a funding mechanism in which an investor provides financing to a startup and in return the investor will receive a percentage eg. Allow you to leverage your personal credit history to access business credit for funding your startup. Share Capital or Equity Shares.

Financials if not current then projected PPAs and relevant. Determining whether you are eligible to apply for and receive a federal grant is very important. Between 2 - 5 of the future revenues generated by the startup.

Get Instantly Matched with the Best Personal Loan Option for You. Working capitalbusiness cash advance. Funding from personal savings is the most common type of funding for small businesses.

Its a good idea to shop around and find the bank that meets your specific needs. It loosens the flow of. While banks may accept some or all of these potential sources of income they will all need to be documented as taxable income shown on a 1040 statement.

Click Now Apply Online. Clause a to e of Section 73 2 will not be applicable on Private Limited Company if deposit is upto 100 of paid up share capital and Free Reserve b. MEDIUM TERM SOURCES OF FINANCE FUNDS.

When considering eligibility the first step is to know what. Here are the other recommended articles on Corporate Finance. Even rent paid by family members may qualify as income.

Private money loans are loans from one individual to another. Consider the fact that all banks offer different advantages whether its personalized service or customized repayment. Start studying Funding Sources Chapter 1 Funding Sources Chapter 2 Funding Sources Chapter 3 Funding Sources Chapter 4 Funding Sources Chapter 5 Funding Sources Chapter 6.

In a recent study we identified 144 nonprofit organizationscreated since 1970that had grown to 50 million a year or more in size. The source of most private money loans are usually from the friends and family of an investor. In order for a suitable funder to assess whether or not your project is worth funding these are some the minimum funding requirements youll be asked for.

Whether you are a retiree with a small fixed income a new business or an established company that needs to maintain a high cash flow the ease and benefits of asset-based loans and mortgages have made them a popular solution for borrowers in recent years. Funding from Personal Savings. If you are not legally eligible for a specific funding opportunity you would waste a lot of time and money completing the application process when you cannot actually receive the grant.

4 We found that each of these organizations grew large by pursuing specific sources of fundingoften concentrated in one particular source of fundsthat were a good match to support their particular types.

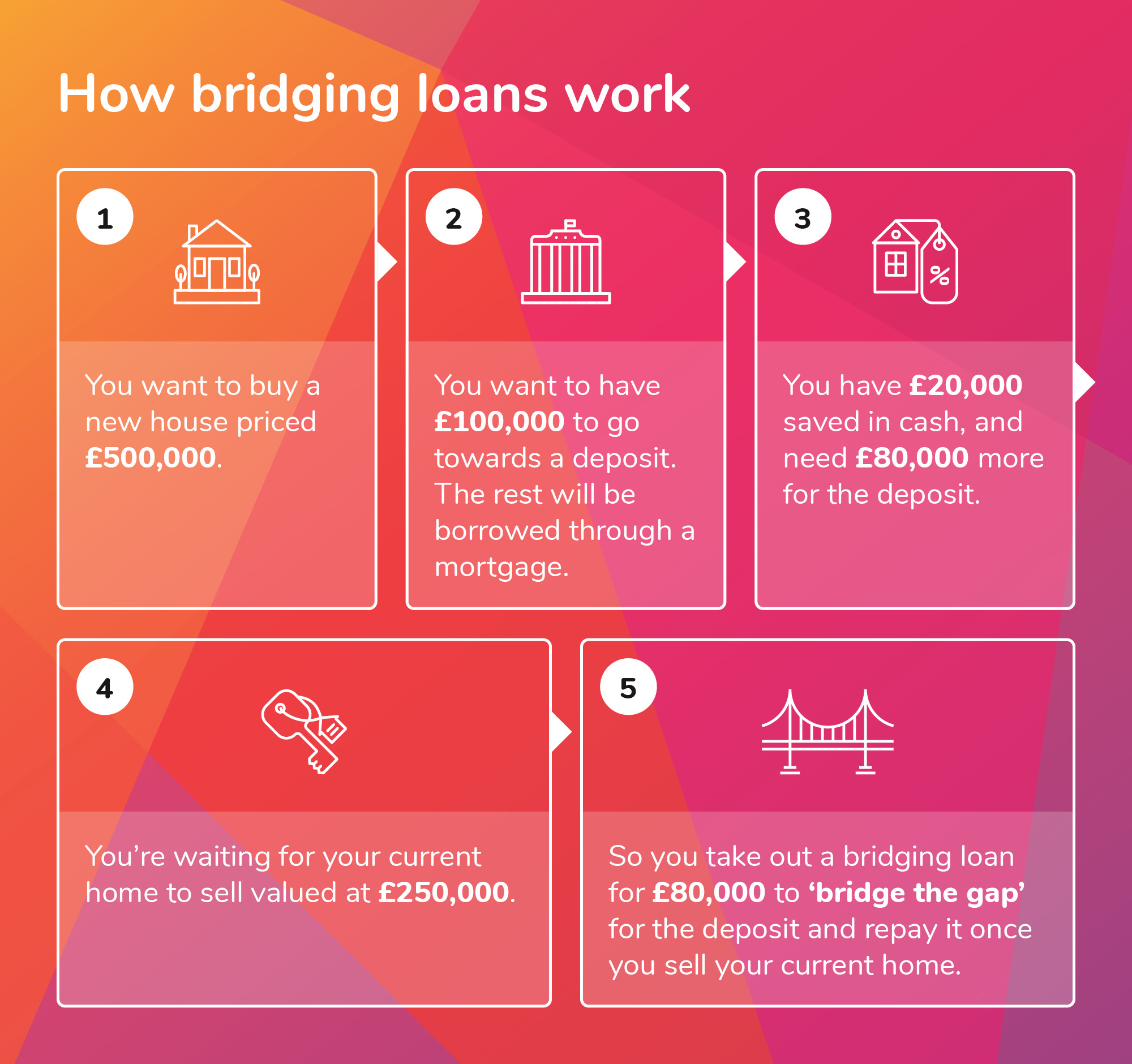

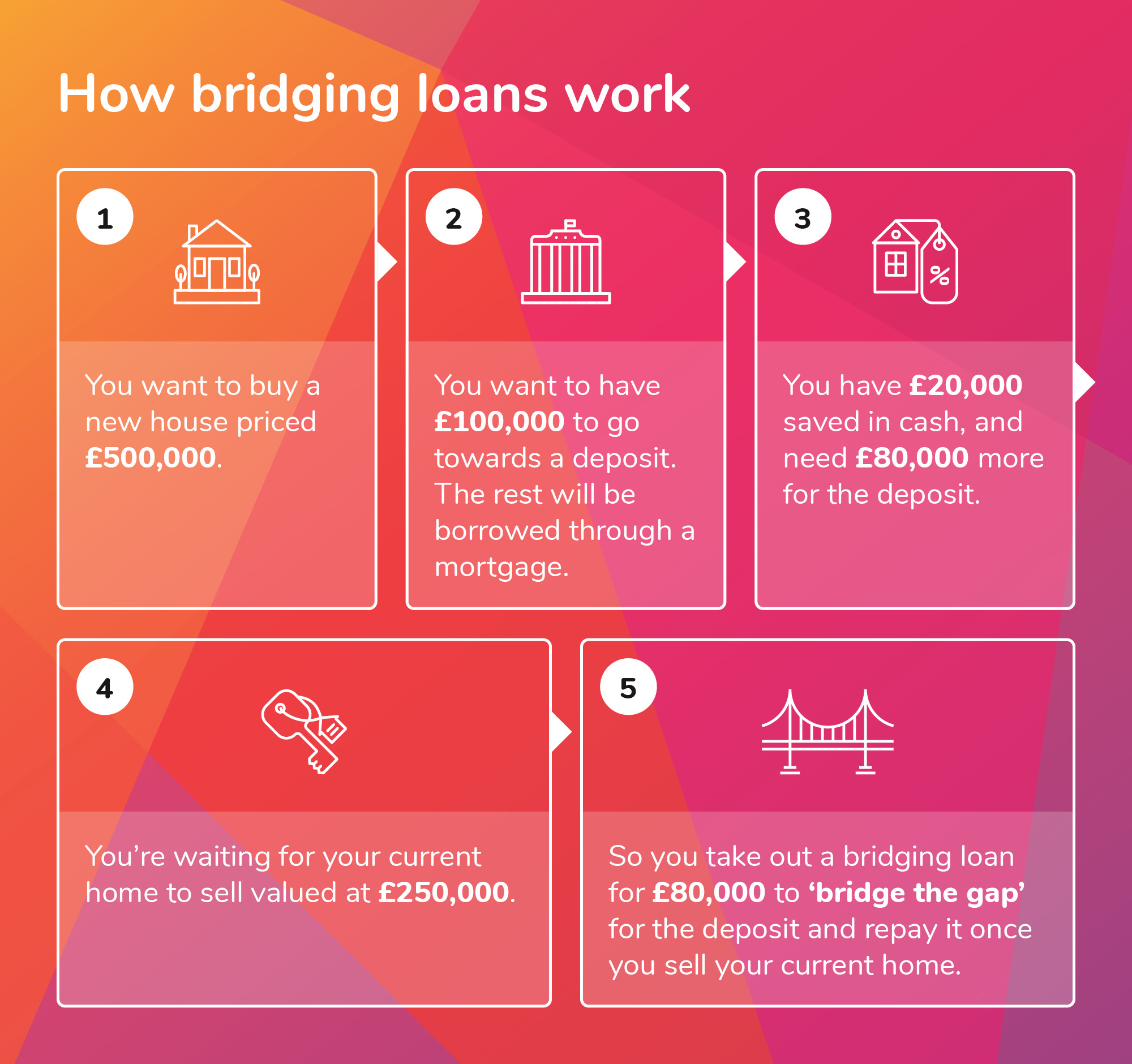

What Is A Bridging Loan Money Co Uk

Use The Interactive Home Loan Emi Calculator To Calculate Your Home Loan Emi Get All Details On Interest Payable A Home Loans Loan Calculator Loan Application

Sources Of Finance For A Small Business Efinancemanagement Com

Comments

Post a Comment